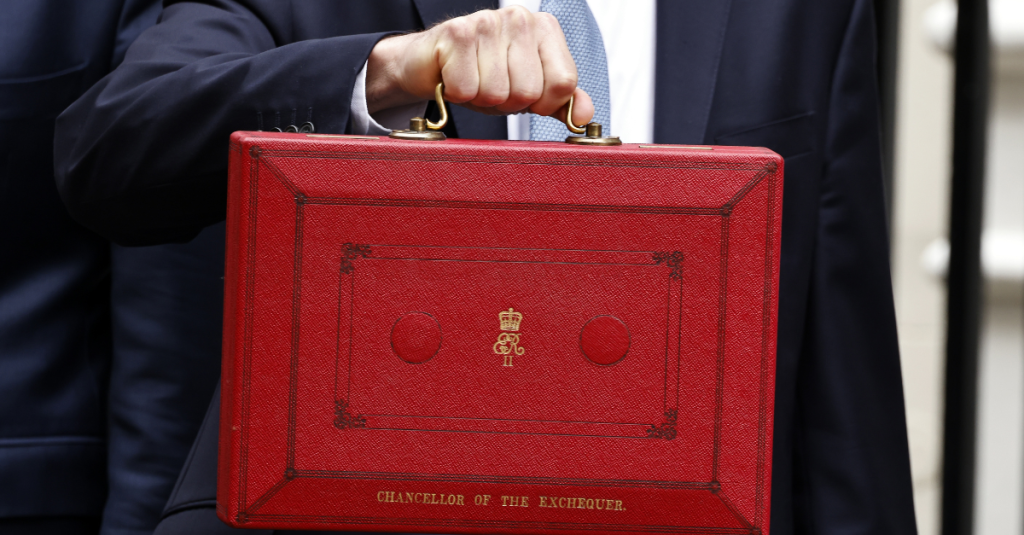

In the wake of the anticipated Budget 2024 announcement, travel industry leaders express mounting concerns over potential rises in employment costs. Chancellor Rachel Reeves is expected to propose significant tax adjustments today, leading to apprehensions about the impact on smaller businesses. Industry experts fear that these measures could escalate operational expenses and limit growth.

The proposal includes a £20 billion increase in business taxes and a 2% hike in employers’ national insurance contributions. These changes come alongside an already confirmed 6.7% rise in the National Living Wage. Travel leaders warn that such financial burdens could hinder the sector’s recovery and necessitate difficult business decisions.

Proposed Tax Increases

Chancellor Rachel Reeves will reveal a series of tax changes aimed at bolstering the economy, yet these are causing unrest in the travel sector. Business taxes are expected to climb by £20 billion, affecting companies of all sizes. The forecasted rise in employers’ national insurance contributions is particularly concerning for smaller firms struggling with narrow profit margins.

Alistair Rowland, CEO of Blue Bay Travel and chair of Abta, has voiced his worries regarding these prospective hikes. He pointed out that with the national insurance increase, compounded by the national living wage adjustment, operational costs could spike by 7% from April. Such a shift may necessitate a re-evaluation of staffing levels and reward structures.

Smaller businesses, in particular, might face a significant financial hit as they strive to manage these increased fixed costs without a proportional rise in revenues. These challenges come at a time when the industry is still recovering from past disruptions, exacerbating an already tough environment for travel operators.

Industry’s Financial Challenges

The expected rise in employment-associated expenses is a troubling prospect for many within the travel industry. The sector is already dealing with reduced profit margins, and this latest development could further strain financial resources.

Julia Lo-Bue Said, CEO of the Advantage Travel Partnership, noted that the ongoing political instability compounds the challenges posed by these potential cost increases. With many businesses carrying substantial debt, and interest rates remaining high, balancing these new expenses will be arduous for owners and operators.

Businesses are caught in a precarious position, unable to increase revenue easily while grappling with climbing costs. The situation requires strategic thinking to navigate these financial hurdles.

Impact on Small and Medium Enterprises

SMEs in the travel sector could bear the brunt of the proposed Budget changes. The government’s emphasis on stimulating growth and aiding small businesses seems counteracted by measures potentially detrimental to their operation.

Martyn Sumners, executive director of Aito, voiced concerns that the Budget might inadvertently harm SMEs, despite governmental assurances to stimulate growth. With profit margins already tight, any additional financial burden poses a risk to their stability.

Companies in the travel industry are evaluating their strategies to cope with these potential hikes. Affected businesses are likely exploring options like cost-cutting measures, staffing adjustments, or even price increases, though these are often difficult to implement without customer resistance.

Wider Economic Implications

Beyond direct cost implications, the proposed Budget changes might have broader economic effects. A potential increase in the cost of sales for travel services is on the table, leading to discussions about price adjustments and market reactions.

Alistair Rowland highlighted how the market’s current flat trend reflects broader consumption patterns. People are hesitant, impacting sales and potentially compounding the effects of any post-Budget foreign exchange fluctuations.

The currency value adjustments post-budget could play a vital role in determining travel competitiveness in international markets, affecting pricing strategies and consumer demand.

Reactions from Industry Leaders

Industry leaders are voicing their concerns, hoping for measures within the Budget to mitigate the financial impact on businesses. Coordinated advocacy efforts are ongoing as leaders strive to ensure the sector’s sustainability.

The sentiment across the sector is cautiously optimistic, with many hoping that the government will consider their feedback. Discussions are afoot about how to collaboratively address these fiscal challenges and ensure a supportive environment for the industry.

Travel industry stakeholders remain committed to dialogue, seeking adjustments that may alleviate the burden these changes might introduce. It is hoped that sustained engagement with policymakers will lead to more tailored economic solutions.

Potential Strategies for Adaptation

Faced with impending financial challenges, travel companies are exploring adaptive strategies. Cost management, innovative service offerings, and operational efficiency improvements are critical to maintaining competitiveness.

Alistair Rowland suggested that businesses might consider consolidation of headcount or reduction in bonus allocations to manage payroll expenses. While these measures are not ideal, they represent practical steps some companies may need to consider.

Investment in technology and digital platforms could offer travel companies a pathway to streamline operations, reducing expenses and enhancing customer engagement even amidst fiscal pressures.

Sector’s Resilience and Innovation

Despite these looming challenges, resilience remains a cornerstone of the travel industry. By leveraging new strategies and adapting to changing conditions, the sector continues to seek pathways to sustainability.

Collaboration across companies and with governing bodies is essential. Industry players are working together to innovate and share best practices, reinforcing the sector against economic fluctuations and ensuring that growth remains achievable.

The travel industry has consistently demonstrated an ability to rebound from setbacks. With a focus on innovation, the sector aims to not only weather the storm but emerge stronger and better equipped for future challenges.

The anticipated Budget 2024 changes present notable challenges for the travel industry, particularly concerning rising employment costs. However, with strategic planning and innovation, the sector can navigate these obstacles and continue its recovery journey.